How bank branches can maximize video surveillance for increased security

- August 7, 2024

- Posted by:

- Category: Blogs

Over the past few years, significant attention has been directed toward digital data security in safeguarding one’s privacy amidst the dynamic scene of cyber threats. However, the protection of physical sites like branches, data centers, and business offices is equally crucial for banks and financial organizations to deter theft. property damage, and unauthorized entry.

Consequently, video processing and analytics has become critical security tool that enables security guards to track individuals and vehicles. grant or deny access to specific areas within the facility, and keep an eye on the building’s entrances and exits.

In today’s ever-changing environment and digital transformation. many financial organizations are now starting to evaluate the use of cutting-edge video analytics, powered by artificial intelligence. Real-time video analytics involves the use of advanced algorithms to analyze video footage from surveillance cameras. identify patterns, and extract business intelligent insights to boost security, efficiency, and decision-making processes.

With many banks actively looking to innovate in the industry to enhance customer experience. AvidBeam‘s video AI analytics solutions have transcended the traditional sphere of security surveillance and ventured into the realm of operational business intelligence.

This blog aims to provide a comprehensive overview of the profound impact AvidBeam‘s advanced video analytics has had on the banking industry. showcasing the evolution from conventional surveillance to a data-driven, proactive approach that fosters growth and innovation.

Enhancing Banking Security and Fraud Prevention

Protecting vulnerable areas is a vital imperative from high-security vaults to restricted access server rooms. each plays an important role in safeguarding the financial sector’s integrity.

Acknowledging this vulnerability. Financial institutions are increasingly relying on cutting-edge intrusion and loitering detection systems to strengthen their security measures. AvidBeam‘s video processing and analytics solution is at the forefront of this field. employing innovative technologies to track and respond to unauthorized access attempts in these highly sensitive regions.

The banking domain, realizing the need for strict access control. Has chosen biometric identification systems as a trustworthy technique for ensuring that valuable assets and data are secure.

How bank branches can maximize video surveillance

AvidFace‘s video AI captures the faces of people entering the branch by analyzing distinctive facial traits. Powerful face capture analytics and search algorithms have made it possible for financial institutions to quickly and accurately identify individuals by setting alerts for suspects to better protect assets. speed up investigations of identity theft and robbery, and create stronger cases to submit to law enforcement.

Among the benefits of video AI solutions is proficiently alerting security personnel about unattended objects. For timely investigation through sophisticated surveillance tech. Meanwhile, the detection of fire and smoke instances is also a pivotal concern that modern CCTV systems can combat.

Safety and security do not commence at the entrance only, rather, it goes far beyond the physical bounds of a premise. Any financial institution’s perimeter serves as the first line of defense. forming a crucial zone where potential threats can be found and mitigated.

By leveraging AvidAuto’s video analytics for banking. License plate recognition from AvidBeam can read the Arabic/English license plate of a vehicle in real-time, and then compare or add to a pre-defined list. This proactive approach empowers security personnel to swiftly generate an alert to any potential security breaches. Such as illegal parking, wrong directions, unauthorized access to gates, suspicious activities, and other vehicular violations.

The video AI analytics can also grasp additional forensic information like the make. Model, and color of the vehicle and an image of the driver to optimize overall security measures.

Optimizing Operational Efficiency and Customer Experience

Banking customers now expect a digital and self-service experience. Which has resulted in significant changes in how people bank and financial services institutions are boosting customer satisfaction, optimizing staff allocation. Increasing operational efficiency, and improving bank layouts.

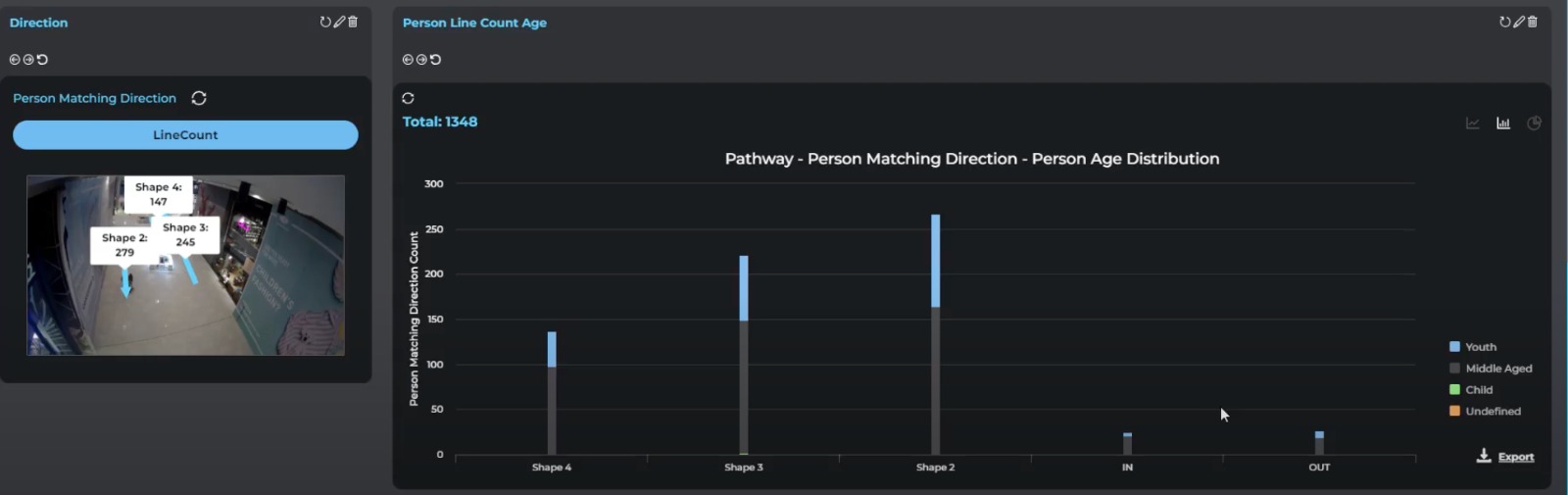

Video surveillance and analytics can assist banks in innovating their existing product offerings. Targeting marketing efforts, and tailoring customer experience. This might be accomplished by obtaining demographic data about customers that determine a person’s age range and gender across branch locations. By using biometric identification. Banks can recognize customers as soon as they enter, enabling personalized promotions that are specific to their age and gender. Which increases brand loyalty and retention.

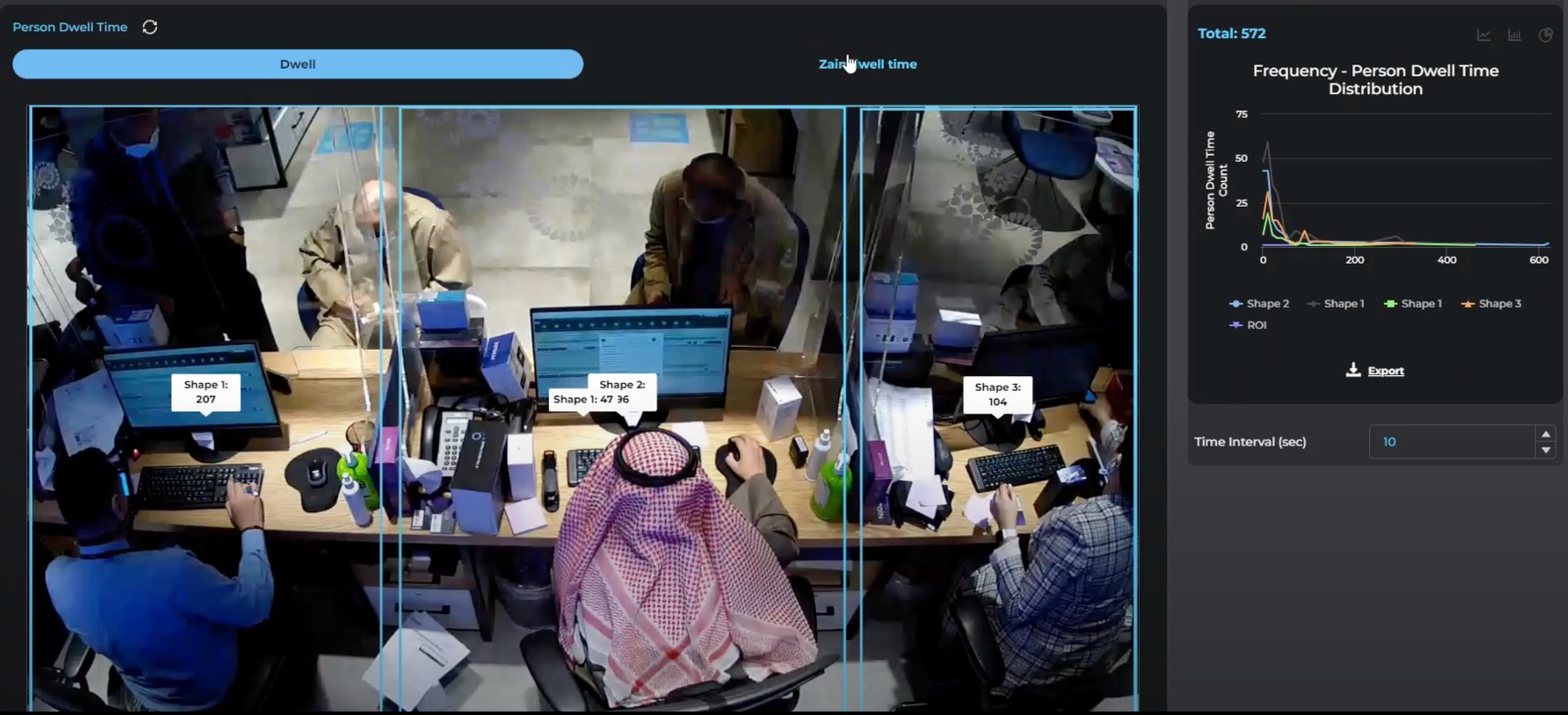

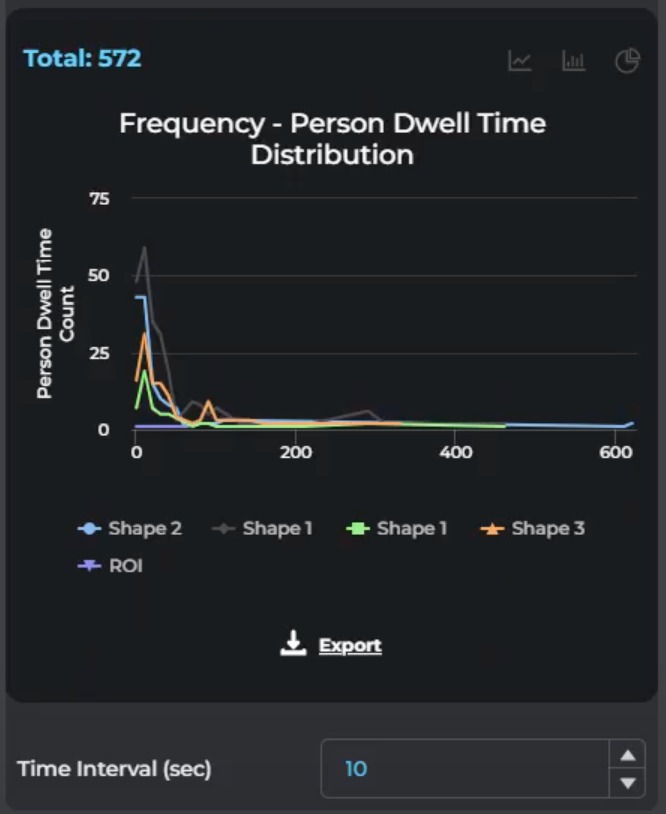

Our behavior video analytics generates strategic insights into detailed customer journey maps within the bank facility. So bank managers can utilize these valuable statistics productively to optimize resources. Improve staff allocation, and determine optimal opening hours.

Visitor counters, in parallel, precisely monitor the traffic flow of customers throughout the day. This robust density analytics solution provides the data to comprehend footfall. The time spent waiting in queues for teller and management services or withdrawing cash from an ATM.

Analyzing the flow of customer traffic enables the branch to deliver a better customer experience. Evaluate special promotions, reduce wait times, and improve queue management for customers.

Addressing Compliance and Regulations

Addressing compliance and regulations is a primary problem for banks and financial institutions. In the light of the pandemic, stringent adherence to social distancing requirements has become a critical part of regulatory compliance. Advanced video analytics are critical in imposing social distancing measures within banks. Furthermore, the use of mask detection technology has grown in popularity as a tool for enforcing health and safety laws. Financial institutions proactively maintain a safe atmosphere by quickly detecting those who are not wearing masks in public settings, according to both local rules and worldwide health norms. Overall, the combination of these technologies contributes greatly to maintaining compliance and building a safer, more rule-abiding workplace.

Conclusion

AvidBeam’s innovative video analytics systems have been successfully implemented in one of the prominent banks in Egypt to protect important assets and sensitive data. Also optimize operational procedures, greatly boosting efficiency and client experiences. AvidBeam‘s presence in this arena highlights a transitional period in which data-driven decision-making and intelligent automation are at the forefront of innovation. Offering a more secure and simplified financial landscape.

Also you can more about: Face Recognition Technology: The Ultimate Guide

4 Comments

Comments are closed.

[…] you can learn more about: Video Analytics for Banking industry .vc_custom_1452662185213{margin-bottom: 40px !important;}.vc_custom_1452662201783{margin-right: […]

[…] its heart, video analytics for banking transforms traditional surveillance cameras into intelligent systems. These AI-driven tools don’t just record footage; they analyze it in […]

[…] Also you can learn more about: Maximize video surveillance […]

[…] banking institutions across the continent can use advanced video analytics in Africa […]